UPCOMING EVENTS AND INFORMATION SESSIONS:

Making a decision about Medicare?

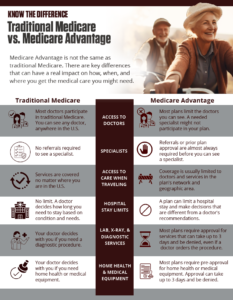

Know the Difference

Medicare Advantage is not the same as traditional Medicare. There are key differences that can have a real impact on how, when, and where you get the medical care you might need.

Each Medicare Advantage plan is also different. Comparing each plan’s covered benefits, limits, provider networks, restrictions, and cost-sharing requirements can be challenging, and it can be hard to know if a specific plan will meet your needs should you get injured or sick or become disabled.

What Seniors Need to Know

Medicare Open Enrollment:

October 15 – December 7

Every year during open enrollment, current Medicare enrollees can:

- Switch from one Medicare Advantage plan to another or

- Switch to traditional Medicare coverage or

- Switch from traditional Medicare coverage to Medicare Advantage coverage

Protecting Your Future Self: How Traditional Medicare Might be the Better Long-Term Coverage Choice Than Medicare Advantage

When deciding between Traditional Medicare and Medicare Advantage, the goal

Questions to Ask an Insurance Broker Before Committing to a Medicare Advantage Plan

It can be confusing to navigate health care as you

Traditional Medicare May Offer Texans Greater Freedom Than Medicare Advantage

When you turn 65, you have health care choices: Traditional

Saying Hello to Medicare Advantage Could Mean Saying Goodbye to Your Doctor

While a lower monthly premium and all-inclusive prescription drug coverage

Understanding Medicare Advantage Plans Before You Commit

Choosing the right Medicare coverage can be challenging, as Medicare